R&D Smoothing and Business Cycles

R&D spending analysis visualization

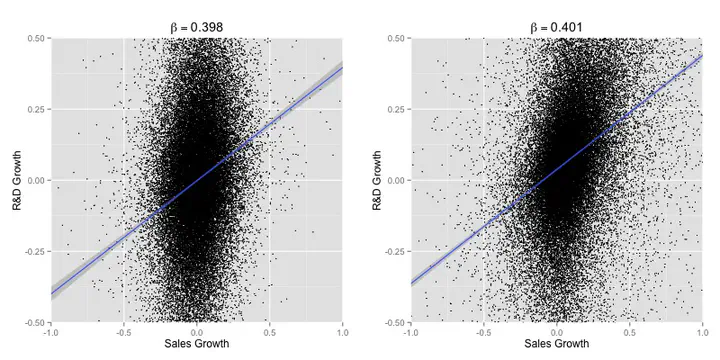

R&D spending analysis visualizationThis research investigates the cyclical pattern of research spending and its implications for business cycle theory. Using industry and firm-level data on research spending and value added, we revisit the debate over the cyclical pattern of R&D and its implications for Schumpeter’s opportunity cost hypothesis.

Key Findings

The results overwhelmingly suggest that there is a significant degree of smoothing in research spending, which implies both:

- Pro-cyclical behavior in its growth rate

- Counter-cyclical behavior in the share of R&D on output

Evidence supports a modified version of the opportunity cost hypothesis, with firms investing counter-cyclically in research as measured by its ratio with respect to the sum of R&D and capital expenditures.

Methodology

The study examines:

- Industry and firm level data on research spending

- Value added metrics

- Impact of financial constraints

- Cyclical patterns in different economic conditions

Empirical Support

Established theories for the observed pro-cyclical behavior were formally tested, with those based on the demand-pull idea receiving significantly more empirical support than alternatives such as internal and/or external financial constraints.

Implications

This research provides important insights for:

- Business cycle theory

- R&D investment strategies

- Economic policy making

- Understanding firm behavior during economic fluctuations

The findings suggest that while R&D spending shows pro-cyclical tendencies in growth rates, firms actively work to smooth their research investments across business cycles, indicating sophisticated strategic planning in research investment decisions.